Citing inconsistencies in population growth rate and the pace of the economy, stakeholders in the private sector have raised concerns about the sustainability of Nigeria’s debt profile considering the level of development in the real sector and other key drivers of the economy.

Indeed, they noted that Nigeria’s debt profile may increase if managers of the economy do not address key indices hindering economic growth.

These were words of the Chief Economist, PWC, Andrew Nevin, at a roundtable on Nigeria’s debt sustainability organised by the Lagos Chamber of Commerce and Industry (LCCI), in Lagos.

“Unless Nigeria gets its growth rate up, we are not going to address our debt crisis,” he said.

Meanwhile, the Managing Director and Chief Executive Officer, Financial Derivatives and Company, Bismarck Rewane, expressed concerns that Nigeria’s debt profile is not yielding investments, but being used to finance deficits.

“We are concerned that if debts are not used to invest, but used for spending and consumption, we are going to move from having a debt problem to a debt crisis and apparently a debt trap,” he said.

Nevin explained that the federal government must as a matter of urgency, develop policies that promote growth, eliminate fuel subsidy and improve on the global ease of doing business.

Although, he said despite increased borrowing, Nigeria’s debt to GDP remained low relative to other government.

According to him, Nigeria must prioritiSe developmental efforts on the real estate sector, advising that investors would welcome initiatives aimed at making the real sector improve.

“The nation is growing quickly and in per capita terms, we declined in 2015, we declined significantly in 2016, we declined in 2017 and we are declining in 2018, we are to decline likely in 2019, and the IMF report stated that we would decline in 2020, 2021 and 2022, and eight years of declining of GDP per person in simple terms means we are getting poorer and poorer every year,” he said.

He said Nigeria has to grow its economy at eight per cent annually to reduce poverty, unemployment and underemployment of its teeming youthful population.

Rewane said data shows that debt is growing at a rate faster than the nation’s Gross Domestic Product (GDP), stressing that Nigeria’s debt profile is also growing at a time when productivity is declining.

“We are borrowing $2.8 billion to finance a deficit which is basically spending. The solution is that we have to increase the injection and investment levels into the economy; this is the only way to increase output and employment. We have to increase the level of confidence to attract investments. The level of confidence is a function of what you do rather than what you say. Policy makers have to be more collaborative, they need to be more honest than being ambivalent and more than anything else, we have to align the goals of government, local and foreign investors,” he said.

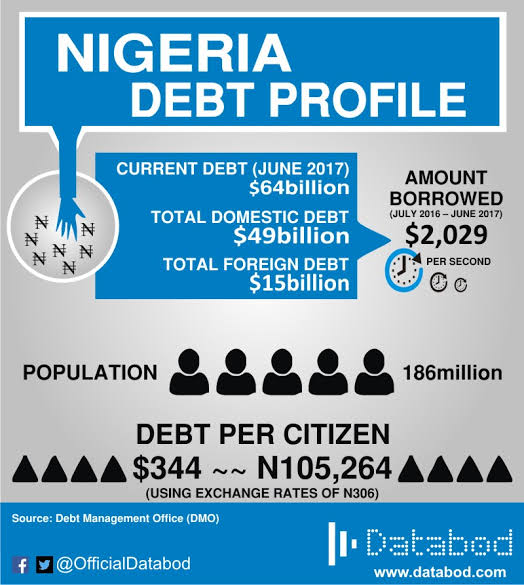

The president, LCCI, Babatunde Ruwase, said the Debt Management Office (DMO), put the nation’s total debt stock at N22.38 trillion as at June 30, 2018, expressing concerns about the rapidly growing public debt and the implications for the country’s fiscal sustainability.

He said debt service to revenue ration which currently stand at over 40 per cent is on the high side with implications on the country’s capacity to deliver infrastructure investments.

A Partner, KPMG Nigeria, Oyelami Adegoke, said Nigeria’s debt level at 22 per cent is a cause for concern, saying that with this rate, Nigeria’s debt servicing will be higher than the federal government’s revenue in the next five years.

He said Nigeria’s debt servicing ration currently at 60 per cent is expected to grow to 120 per cent in 2023.

text