Digital banking platforms are becoming inherent in our lives. People want personalized banking services that are easy and convenient for them to access from anywhere. Users also want to sign up for these services without having to leave their comfort zones and this is what Tymebank offers.

Licensed in South Africa since 1999, Tymebank touts itself as the first digital-only bank to launch in the country. This is because the bank does not have any physical bank branches, but relies solely on digital means (online/mobile, and its points-of-presence).

Users are able to operate Tymebank accounts like regular bank accounts. They are able to pay bills with their accounts, transact on platforms like the web and POS with the debit card provided to them, as well as send and receive money. Users can also save money with Tymebank’s savings tool –GoalSave — and get as much as 10% interest.

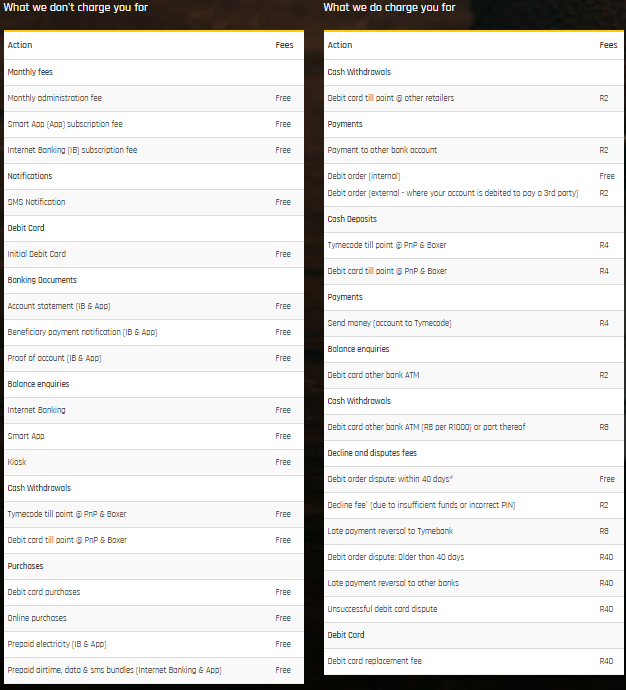

in all of these, it prides itself to be a cheaper alternative to traditional banks as users pay less for. The highest fee charged for transactions is R8 (N199.23).

“TymeBank is a new kind of bank that’s digitally smart. The money we save by not having branches benefits you, it means you pay a lot less for banking. We have no monthly fees, many everyday banking transactions are free, and there are very low charges for other transactions.”

To sign up

The digital-bank does not require any documents and any charge. Users would only need to log on the company’s website and provide a valid South African ID number and a cellphone number, which the bank verifies with a One-time PIN (OTP).

Users would also need to answer some question to verify their identity. Once this is done users already have an account but will be limited in their transactions.

Benefits

To unlock the full benefits of their accounts, users will need to go to a Tymebank point-of-presence and upgrade their account, for free. Here their biometrics will be captured and residential address will be registered. And users will get a free debit card.

Users can also choose create their account from start at the point-of-presence instead of online.

Federal Insurance Contributions Act (FICA) is done upon this verification and details are crosschecked/confirmed against the existing data with the Department of Home Affairs.

Currently, the bank has 80,000 customers and 700 points of presence, where customers can open/verify accounts. The digital-bank recently raised a R200m investment to help it scale.

Moving forward

Tymebank is planning to have over 10,000 service points across 1,500 stores, where customers can withdraw and deposit money. In addition to this, the startup will be introducing credit products later this year, as well as SME propositions for